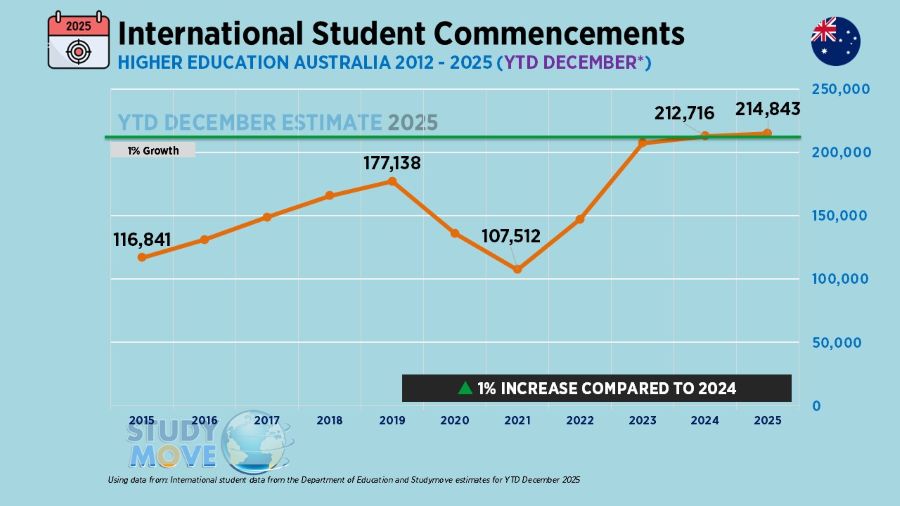

Australia’s higher education sector has entered 2026 with international student commencements broadly flat, defying expectations of a sharper correction after two years of sustained policy disruption.

Presenting final commencement estimates for 2025, Studymove managing director Keri Ramirez said international higher education commencements were expected to increase by around 1 per cent year on year, effectively unchanged in volume, but notable given the cumulative impact of visa reform, ministerial direction and integrity measures introduced since 2023.

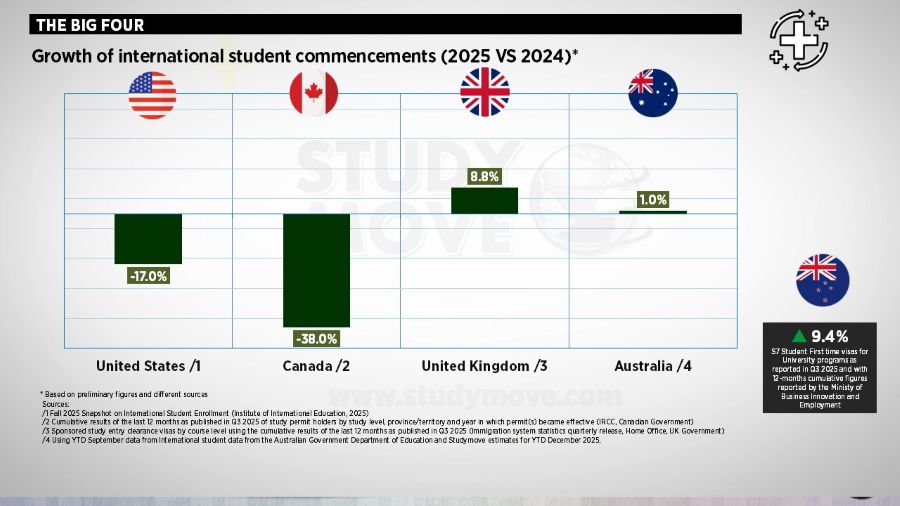

Placed in an international context, Australia’s performance sits between stronger rebounds in some markets and pronounced declines in others. Based on available data, the United States is tracking a 17 per cent decline in commencements, Canada a 38 per cent fall following the introduction of hard caps, while the United Kingdom has recorded 9 per cent growth in student visas. New Zealand continues its post-pandemic recovery, with commencements up 9.4 per cent.

Ramirez said Australia’s relative stability came despite what he described as “constant policy change”, with universities adjusting to successive rounds of reform, including the introduction of Ministerial Direction 111 and subsequent integrity settings.

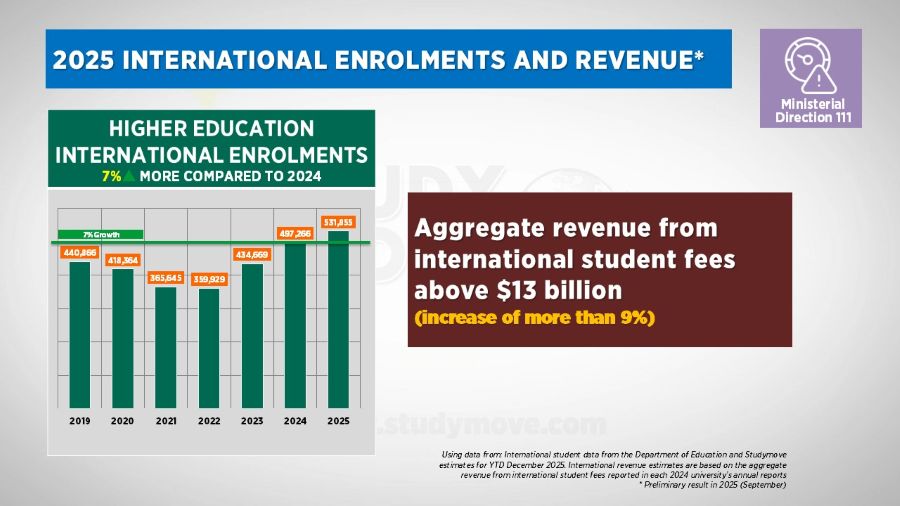

While commencements have plateaued, overall enrolments continue to rise. Total international higher education enrolments are forecast to grow by around 7 per cent in 2025, reflecting the legacy of strong intakes in previous years and providing some financial cushioning for institutions navigating higher compliance and recruitment costs.

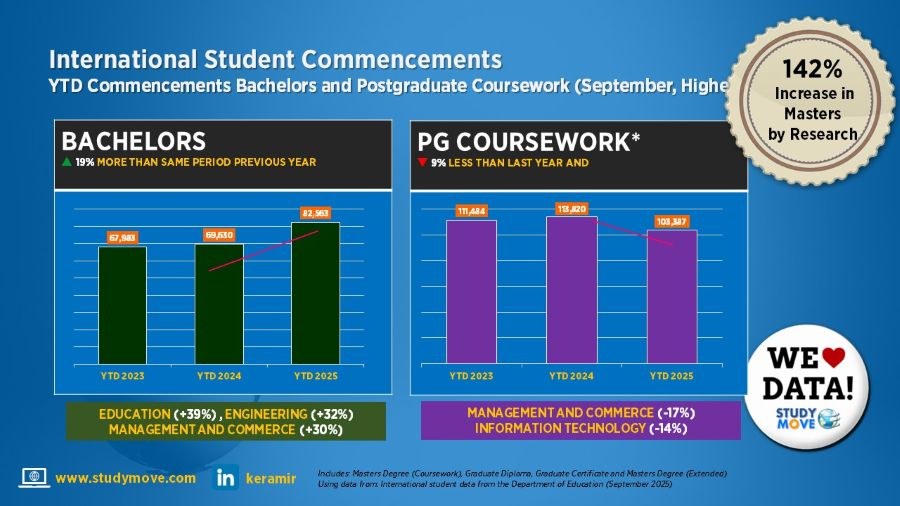

Beneath the headline numbers, however, outcomes vary significantly by level of study and field. Undergraduate commencements are expected to rise by 19 per cent, driven by strong growth in education (39 per cent) and engineering (32 per cent). Postgraduate coursework commencements, by contrast, are forecast to decline by 9 per cent, suggesting heightened sensitivity to tighter visa settings among older student cohorts.

Master’s by research commencements are also expected to increase sharply, rising from around 1,000 in 2024 to approximately 2,200 in 2025. Ramirez cautioned that while research growth is not inherently negative, the shift warrants close monitoring to ensure program integrity is maintained.

Source market performance also diverged. China recorded a 5 per cent decline in commencements, largely driven by postgraduate students, while undergraduate numbers edged higher. India returned to modest growth of 2 per cent following a sharp fall in 2024. Nepal emerged as one of the strongest-performing markets, with commencements up 27 per cent, while Bangladesh recorded growth of 45 per cent, becoming Australia’s fourth-largest source market for higher education students.

At the same time, commencements from Pakistan and Bhutan fell sharply, declining by 38 per cent and 32 per cent respectively.

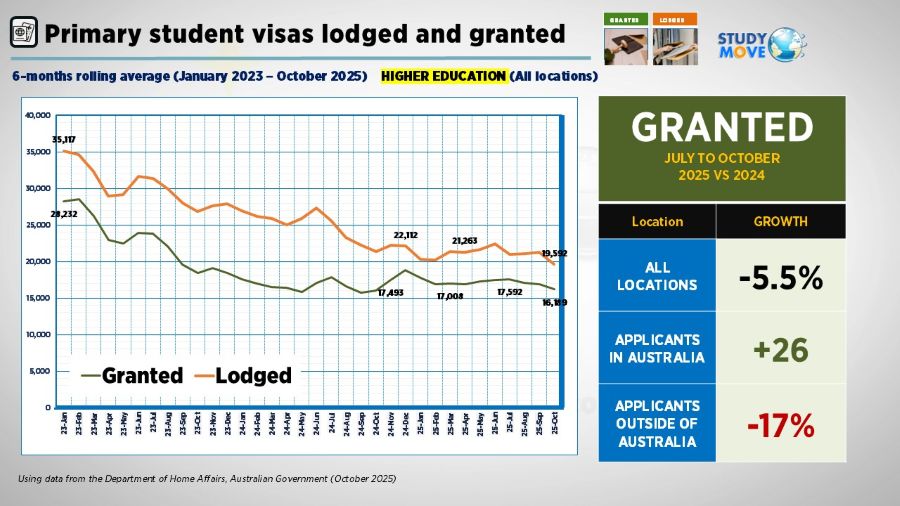

Looking ahead, Ramirez said early indicators for 2026 point to a more stable, though slightly softer, environment. Visa lodgement and grant volumes have stabilised following earlier volatility, but remain around 5.5 per cent lower than the same period last year. On current trends, commencements of approximately 200,000 students are anticipated in 2026.

Policy settings are expected to remain largely unchanged in the year ahead, though their practical impact will become more visible. While overall new overseas student allocations have increased by around 9 per cent, nearly half of universities face constraints on growth under the allocation framework, while others retain room to expand.

In response, institutions are adjusting recruitment strategies, with greater focus on admissions quality, compliance oversight and visa readiness. Ramirez said these shifts are contributing to rising recruitment costs, driven by additional staffing, systems and governance requirements.

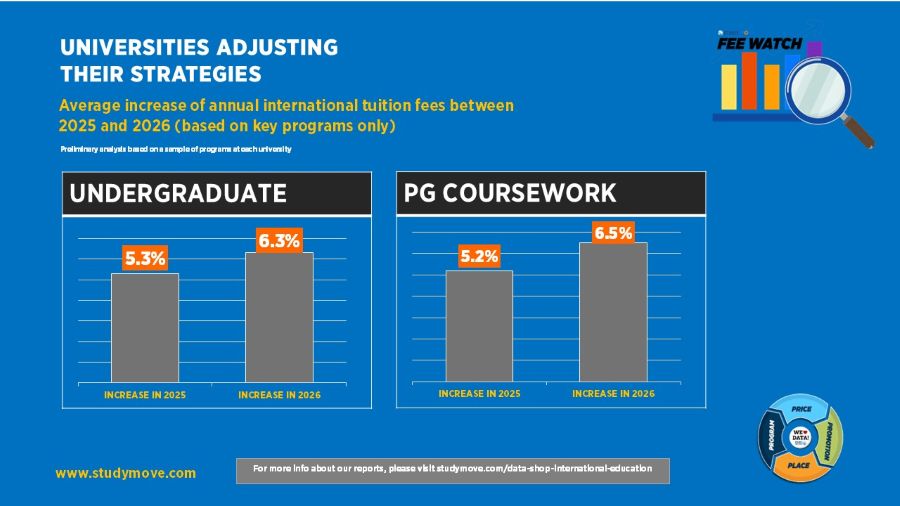

Fee increases and more targeted scholarship approaches are also becoming more evident, with average undergraduate fee rises of more than 6 per cent reported in 2025, alongside more selective use of financial incentives earlier in the conversion cycle.

As the sector moves into 2026, the data suggests a period of consolidation rather than expansion, with universities operating under tighter settings while adapting to a more compliance-driven operating environment.